When the Intermountain Power Project went online in Utah in 1986 it was the largest coal plant in the United States. For the next three decades it was Los Angeles’ single largest power source. But California – like eleven other states, territories, and DC – is committed to a 100% clean energy requirement, in their case by 2045. Will Intermountain Power Project have a role to play in California’s energy future?

Potentially. What is unique about Intermountain Power Project’s location is that it sits on an underground salt dome roughly three miles wide and one mile deep – a salt dome that could store green hydrogen, which is the focus of the Advanced Clean Energy Storage (ACES) project. ACES would fuel a transformed Intermountain Power Project able to burn hydrogen in a conventional gas turbine. Current plans are to first burn a blend of hydrogen and natural gas (by 2025) and then burn 100% hydrogen by 2045.

The Utah project is not alone. Last week, NextEra announced plans to invest $65 million in green hydrogen production in Florida. Another exciting green hydrogen project is HYPORT in Oostende, Belgium. This project is exciting because of its potential to create a dispatchable fuel source from offshore wind. HYPORT will be the largest electrolyzer on the planet. When generation from a nearby offshore wind farm exceeds demand, the excess generation will be converted to green hydrogen as a fuel source for electricity, transport, and heat and as a raw material for industrial purposes.

What is green hydrogen?

Using renewable energy to create hydrogen through the electrolysis of water is what makes “green” hydrogen green. Renewable energy is used to power an electrolyzer, which separates hydrogen from oxygen in water. The hydrogen is then stored or used to fuel a power turbine or another industrial application.

The rise of 100% clean energy commitments

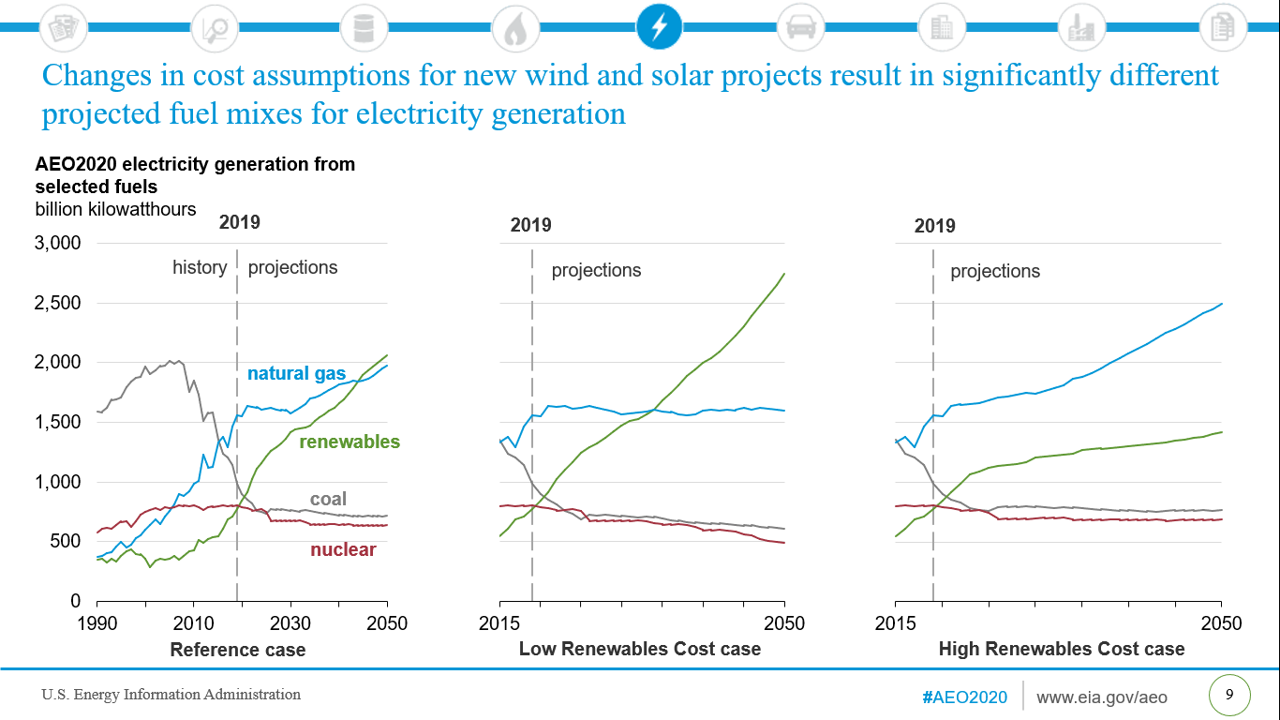

Not that many years ago, commitments to secure a zero-carbon fuel supply were unheard of. Now, states, public companies, campuses, and municipalities, among others, are aggressively working towards 100% clean or renewable energy goals to actively address the threat of climate change. As shown in the figure below, the latest Annual Energy Outlook from the U.S. Energy Information Administration projects in its Reference Case that electricity generation from renewable energy is expected to double in the next 10 years. The EIA assumes the continued decline in the capital cost of renewables and a moderate rise in the price of natural gas will facilitate the continued strong growth of renewable generation.

Renewable energy’s reliability challenge

Solar and wind resources are the fastest growing types of renewable energy, but they are not dispatchable, meaning their electricity supply cannot be turned on, off, up, or down to match electricity demand - resulting in situations where generation can be a lot more or less than consumption. When wind and solar output outstrips demand, it must either be stored in batteries or curtailed. In a curtailment event, wholesale electricity prices fall to zero or even negative numbers. At other times, there is not enough wind and/or solar power, and grid operators must rely on the flexibility of gas fired, conventional, dispatchable generation to back up wind and solar generation. Green hydrogen can potentially address both problems. At times of renewable energy oversupply, the hydrogen production process could utilize low-cost renewable power; at times of renewable energy shortage, green hydrogen could fuel plants able to pick up the slack.

Can green hydrogen compete? Here’s what we’re watching.

Our team is closely following the developments of hydrogen technology and considering when and how it should be incorporated in our long term electricity price forecasting and market analytics services. As with any new technology, the biggest obstacle for green hydrogen is currently cost. The electrolyzer process is very expensive, but its price is falling similar to that of solar and storage. Over the last five years the technology became 40% cheaper, and there are expectations that it will be approximately 30% cheaper by 2025.

A study by Bloomberg New Energy Finance (BNEF) found that “clean hydrogen could be deployed in the decades to come to cut up to 34% of global greenhouse gas emissions from fossil fuels and industry – at a manageable cost.” Its largest competitive challenge is the price of natural gas. Asia is expected to be a center of global economic growth and has accelerated their natural gas imports over the last decade, a trend that is expected to continue. The BNEF study suggests that green hydrogen could be produced at an “equivalent natural gas price of $6-12/MMBtu by 2050 making it competitive with the current natural gas prices in Brazil, China, India, Germany, and Scandinavia on an energy equivalent basis.”

Public policy could speed things along. Adopting a carbon price regime would increase green hydrogen’s competitiveness with natural gas. The same BNEF study found that “a carbon price of $32/tCO2 would be enough to drive fuel switching from natural gas to hydrogen” by 2050. Other government regulations and policies could also speed up the enabling and integration of green hydrogen. For example, this month the European Union released a hydrogen strategy “to drive a systemic shift away from fossil fuels, as a means [for] meeting its energy and climate goals.“

Significant challenges remain, however. Hydrogen molecules are very small, making them hard to transport; to do so with conventional natural gas pipeline infrastructure would require engineering modifications. As most people know, hydrogen can cause fires and explosions due to its wide flammability range and is therefore stored and moved at high pressures. The cost of safety compliance could be a hurdle to widespread acceptance.

Widespread adoption of green hydrogen technology would require major infrastructure investment—converting natural gas plants and potentially upgrading the natural gas pipeline infrastructure to handle hydrogen transport. However, if states are to meet their ambitious clean energy goals, green hydrogen is a potentially valuable tool that is in the running to play an important role in a transformed clean energy system.

We are looking forward to continuing the conversation,

Chris Jylkka | Senior Consultant | cjylkka@daymarkea.com

Aliea Afnan | Consultant | aafnan@daymarkea.com